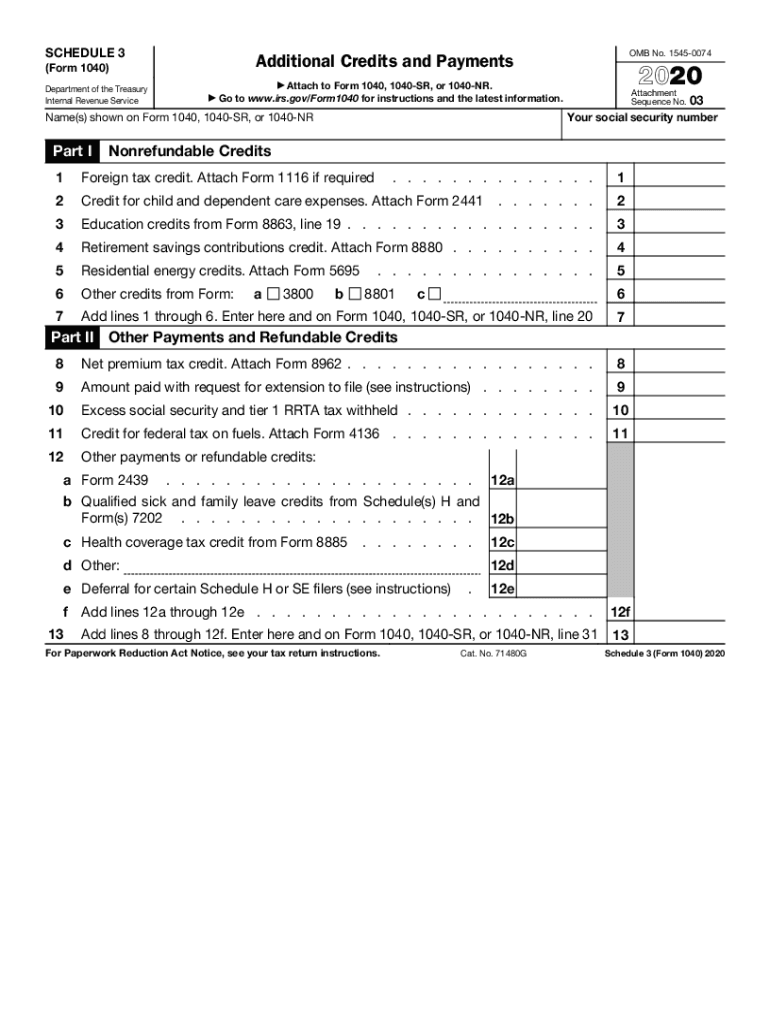

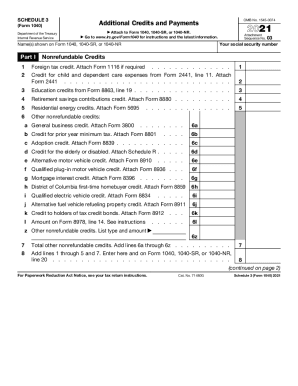

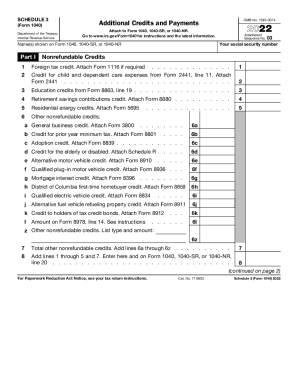

2024 Form 1040 Schedule 3 Form 1040 – The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible to claim nonrefundable credits must complete Schedule 3 and attach it to their 1040 return. Nonrefundable credits . This includes items such as: You can also use other IRS schedules (additional forms) with Form 1040-SR, such as Schedules 1, 2, and 3, to report information not directly reported on Form 1040-SR. .

2024 Form 1040 Schedule 3 Form 1040

Source : www.dochub.comSchedule 3 2020 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.com2023 schedule 3: Fill out & sign online | DocHub

Source : www.dochub.com1040SCHED3 Form 1040 Schedule 3 Additional Credits & Payments

Source : www.greatland.comSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.comSchedule 3 2021 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comIRS 1040 Schedule 3 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comIRS Form 1040 Schedule B 2021 Document Processing

Source : www.ocrolus.comFederal Income Tax Spreadsheet Form 1040 (Excel Spreadsheet

Source : sites.google.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Form 1040 Schedule 3 Form 1040 Schedule 3: Fill out & sign online | DocHub: As federal student loan payments resume for over 28 million borrowers post-pandemic, a silver lining emerges in the form of potential tax savings through the student loan interest deduction (SLID). . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

]]>